Current state and forecasts for data center market in Poland

According to the report “Data Center Market in Poland 2022” published in May by PMR research company, last year’s increase in space of facilities providing colocation and hosting services amounted to 12%. In terms of power capacity, the data center market increased by as much as 1/5 in 2021. And what are the forecasts?

According to the report “Data Center Market in Poland 2022” published in May by PMR research company, last year’s increase in space of facilities providing colocation and hosting services amounted to 12%. In terms of power capacity, the data center market increased by as much as 1/5 in 2021. And what are the forecasts?

Power capacity

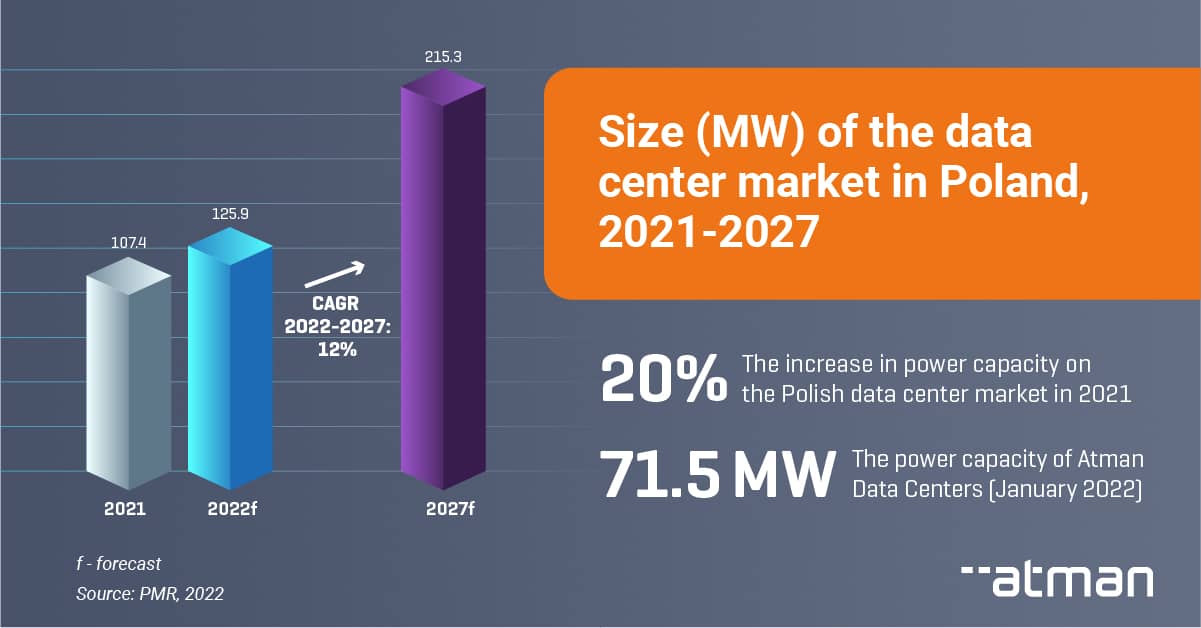

After several years of downward dynamics in terms of power capacity, the market gained slight momentum in 2020 (less than 6% up year-on-year) to record a jump of almost 21% year-on-year in the following year. The total capacity available on the DC services market in Poland then exceeded 107 MW. According to PMR analysts, data centers will already have nearly 126 MW at their disposal at the end of this year.

In a few years’ perspective, the volume of data center power capacity in our country will continue to grow, although at a gradually declining rate. The expected market size in 2027 will be 215 MW, i.e. over 100 MW more than in 2021. Interestingly, PMR’s analysis of long-term investment plans in data centers in Poland revealed that the target capacity of these centers may reach 300 MW.

Data center space

The PMR report notes nearly 150,000 sq. meters of gross data center space in 2021 and an increase of 12% year-on-year. When we compare it with the data from 2011, it turns out that the space of data processing centers in Poland has more than doubled within a decade – it is exactly 2 and 1/3 times bigger.

In 2022, PMR expects growth of 12.8% YoY, closing December with nearly 168,000 sq. meters of gross data center space in Poland.

According to PMR forecasts, which take into account investment plans of both companies currently operating in our market and completely new players, the gross space of data centers providing commercial services will increase by over 40.3% in the following years, reaching 235.6 thousand sq. meters at the end of 2027. The biggest jump – by 27.8% – will take place by 2025, when large investments in data center facilities in Poland are to be completed.

Leaders: Warsaw and Atman

According to the ranking of DC locations presented in this year’s PMR report, Warsaw leads in terms of both the number (42) and the size of facilities (61%) offering colocation and hosting services. Krakow is also on the podium (12 and over 10% respectively), closely followed by Poznań (9 and nearly 9% respectively). No one should be surprised by the top position. The Warsaw agglomeration is developing rapidly and attracts business, which drives investment in ICT infrastructure.

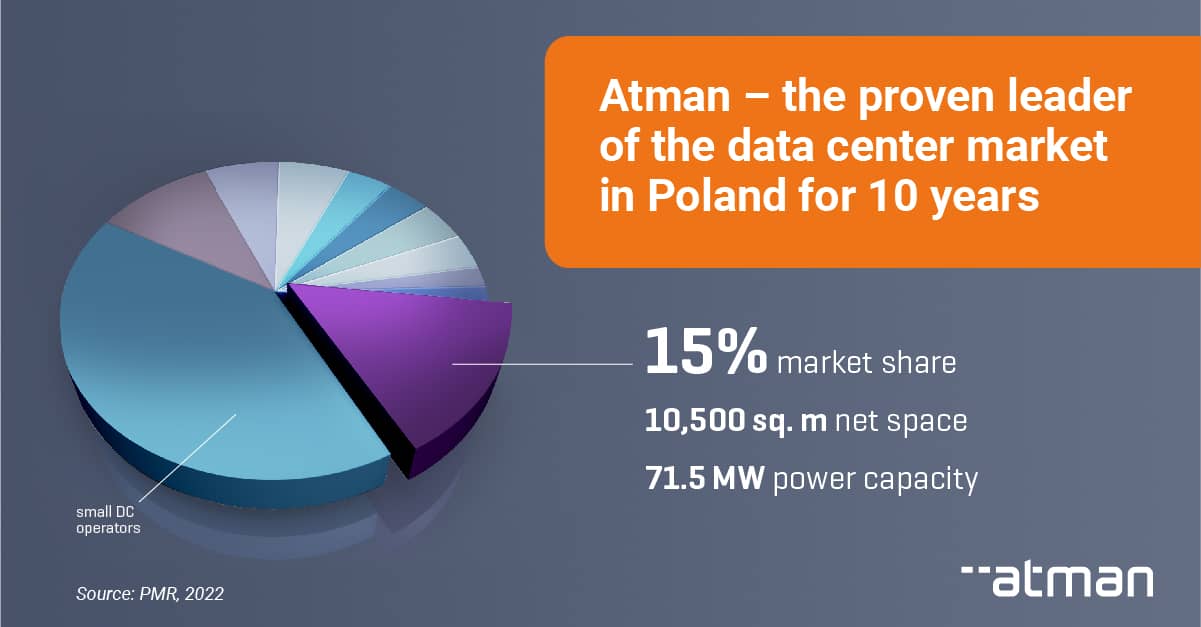

Among others, Atman contributes to the leading position of the capital city. We have been developing our data center infrastructure since 2001 and since 2011 we have been the market leader in Poland. In the TOP 10 list of operators, published in the discussed PMR report “Data Center Market in Poland 2022”, at the beginning of this year our share in the DC market in terms of net space was 15%.

This means that in 2021, when we completed construction and commissioned another state-of-the-art colocation facility, we increased our share by 4% YoY. Building F6 at the Atman Warszawa-1 Data Center has 1.44 K sq. meters of net space (3 K sq. meters of gross space), 3.6 MW of IT power at our exclusive disposal, and is comprehensively connected. The total potential of our colocation facilities is 10.5 K sq. m of net space for colocation, dedicated servers and cloud services (19.5 K sq. meters gross). And later this year we plan to start construction of the combined buildings F7 and F8, which will increase the capacity of Atman Data Centers by 3.6 K sq. meters net.

The PMR report mentions that we also lead in terms of energy capacity available to customers. Currently, our data centers together have 71.5 MW of capacity.

The website uses cookies as described in our

The website uses cookies as described in our